Health insurance is one of the most important financial decisions you can make. It helps you pay for medical expenses, protects you from unexpected healthcare costs, and ensures you get the best treatment when needed.

Medical emergencies can happen at any time, and without insurance, the cost of treatment can be overwhelming. From regular doctor visits to emergency surgeries, medical bills can quickly add up, making it difficult for individuals and families to manage expenses. This is where health insurance becomes essential it provides financial security and peace of mind, knowing that you won’t have to bear the full cost of medical care.

What Is Health Insurance, and How Does it Operate?

Health insurance is an agreement between you and an insurance provider. In exchange for a fixed monthly or yearly payment (premium), the insurance company helps cover your medical expenses. This means that instead of paying the full amount for hospital visits, medicines, or surgeries, your insurer will pay a significant part of the bill.

When you visit a doctor or hospital, you can either pay the bill and get reimbursed later or use cashless treatment at network hospitals, where the insurance company directly settles the bill with the hospital.

Each insurance plan has its own terms, such as how much coverage it provides, what illnesses and treatments are covered, and whether there is a waiting period before you can claim benefits.

Why Health Insurance is a Must-Have

Many people think they don’t need health insurance until they get sick, but by then, it’s often too late. Here’s why having a good health insurance plan is essential:

- Medical costs are rising: The cost of doctor visits, hospital stays, surgeries, and medicines has increased significantly. Even a minor health issue can result in a large bill, which can drain your savings.

- Unforeseen health emergencies: Accidents and sudden illnesses can happen without warning. Health insurance ensures that you get the required treatment without financial stress.

- Access to better healthcare: With insurance, you can choose better hospitals, experienced doctors, and advanced treatments that may otherwise be too expensive.

- Tax benefits: In many countries, you can get tax deductions for paying health insurance premiums, helping you save money.

- Financial security: Without insurance, a single medical emergency can lead to debt. Having a policy protects your finances and helps you manage healthcare costs efficiently.

You May Also Like: Arab-Health-2025

Understanding Different Types of Health Insurance

Health insurance is not a one-size-fits-all solution. There are different types of plans designed to meet various needs:

Individual Health Insurance

This type of plan covers only one person. It’s ideal for single individuals who want personal coverage and do not need to include dependents in the policy.

Family Health Insurance

Family health insurance plans cover multiple members within one policy. It provides a shared coverage limit, meaning if one family member needs hospitalization, the entire sum insured can be used for their treatment. This is a cost-effective option compared to buying separate policies for each family member.

Group Health Insurance (Employer-Sponsored Plans)

Companies often provide group health insurance plans for employees. These plans are often subsidized by the employer, making them more affordable. However, coverage may be limited, so it’s wise to check if additional insurance is needed.

Senior Citizen Health Insurance

Designed for individuals aged 60 and above, these plans cover age-related medical conditions and provide benefits such as home healthcare, regular checkups, and assistance for chronic illnesses.

Critical Illness Insurance

This policy offers a lump sum payout upon diagnosis of life-threatening diseases such as cancer, heart attack, or stroke. The money can be used for treatment, recovery, or any other expenses related to the illness.

Maternity and Newborn Health Insurance

Pregnancy and childbirth involve significant medical costs. Maternity insurance covers expenses such as prenatal checkups, delivery charges, and newborn care. Some policies also provide coverage for fertility treatments.

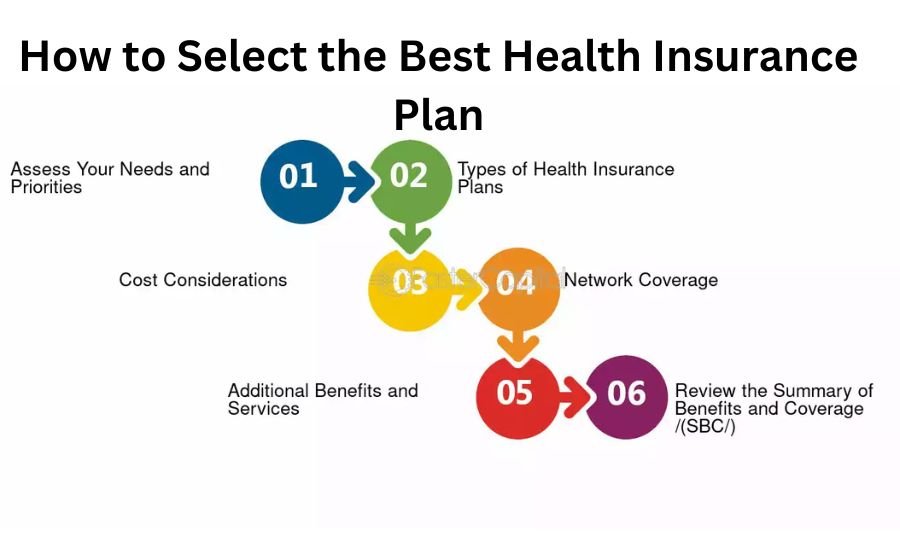

How to Select the Best Health Insurance Plan

Choosing a health insurance plan requires careful consideration.

Coverage and Benefits

The most important aspect of any health insurance plan is what it covers. A good plan should provide coverage for hospitalization, surgeries, ambulance charges, maternity expenses, and critical illnesses. It should also include pre-existing conditions after a reasonable waiting period.

Network of Hospitals

Check whether the insurance provider has tie-ups with reputed hospitals in your city. A strong network of hospitals ensures that you can receive cashless treatment without the hassle of paying upfront and waiting for reimbursement.

Premium vs. Coverage

A low-cost plan may save you money on premiums, but it might not offer sufficient coverage. It’s better to find a balance between affordability and benefits to ensure adequate protection.

Waiting Periods

Some conditions, such as pre-existing diseases, maternity benefits, and specific surgeries, have a waiting period before they are covered. Read the policy details to know when the coverage starts.

Claim Process and Customer Service

A good insurance company should have a fast and hassle-free claim settlement process. Look at customer reviews to see how efficiently claims are processed. Some insurers offer 24/7 customer support, which can be beneficial in emergencies.

Common Health Insurance Terms You Should Know

Health insurance policies often include technical terms that may be confusing. Here’s a quick explanation of some important ones:

- Premium – The amount you pay regularly to keep your insurance active.

- Sum Insured – The maximum amount the insurance company will pay in a year.

- Deductible – The amount you need to pay before the insurance starts covering costs.

- Co-payment – A percentage of the bill you have to pay, while the insurer covers the rest.

- Claim Settlement Ratio – The percentage of claims successfully paid by an insurance company. A higher ratio means better reliability.

- No-Claim Bonus (NCB) – If you don’t make a claim in a year, some insurers increase your sum insured without extra cost.

Conclusion

Health insurance is not just another expense it’s a lifesaver in times of need. It ensures that you and your loved ones get the best medical care without financial hardship. With healthcare costs rising, having a comprehensive insurance plan can save you from unexpected burdens and give you peace of mind.

If you haven’t already invested in a health insurance plan, now is the best time to do so. Compare different plans, read reviews, and choose one that provides the best balance of cost and coverage.

FAQS

Q: What is health insurance?

A: Health insurance is a plan that helps pay for medical expenses like doctor visits, hospital stays, and medicines. You pay a premium, and the insurer covers part or all of your medical costs.

Q: Why do I need health insurance?

A: Health insurance protects you from high medical bills, gives you access to better treatment, and ensures financial security during medical emergencies.

Q: Can you explain the differences between individual and family health insurance plans?

A: Individual health insurance covers only one person, while family health insurance covers multiple family members under one policy.

Q: Does health insurance cover pre-existing diseases?

A: Yes, but usually after a waiting period. The waiting period varies by policy, so check the terms before buying.

Q: What is a cashless hospital network?

A: A cashless hospital network is a list of hospitals where your insurer pays the bills directly, so you don’t have to pay upfront.

Q: How do I file a health insurance claim?

A: You can file a claim either cashless (by showing your insurance card at a network hospital) or reimbursement-based (by paying first and getting reimbursed later).

Q: Can I buy health insurance for my parents?

A: Yes, you can buy a senior citizen health plan for your parents to cover their medical expenses and ensure they get quality healthcare.

Read More: Pure-Health